Gifts of Stock

By donating stock directly rather than selling it and donating the cash proceeds, there's no capital gains tax to pay.

Generally speaking, capital gains tax is a tax on the profit you make from selling your stock. The federal capital gains tax rate can be as high as 20% on stock held for more than one year, and some states also have their own method of taxing capital gains.

If you donate stock you've held for more than one year and itemize deductions, you can generally deduct the full fair market value of the stock.

Here's a quick video about how easy it is to make a gift of your stock click here

Timing matters! Gifts must be made on or before December 31st to count for the current tax year. For example, to make an eligible gift for your 2023 taxes, your stock donation must be completed on or before December 31, 2023 — and if you plan to mail in your forms manually, you should plan to do so by early December. However, most donations to nonprofits occur in the last three months of the year, so by giving before the year-end rush, you can make an immediate difference for safe and affordable housing when it’s needed most and get ahead on your tax savings.

Stock donations are uniquely impactful for Habitat for Humanity of Northwest Indiana and allow you to make an even bigger impact on the causes that matter most. Your gains in the stock market are generally not taxed when you give them directly to a nonprofit. Practically speaking, you can give more without dipping into your everyday funds, and we can put the full value of the stock to work to build strength, stability, and self-reliance through shelter!

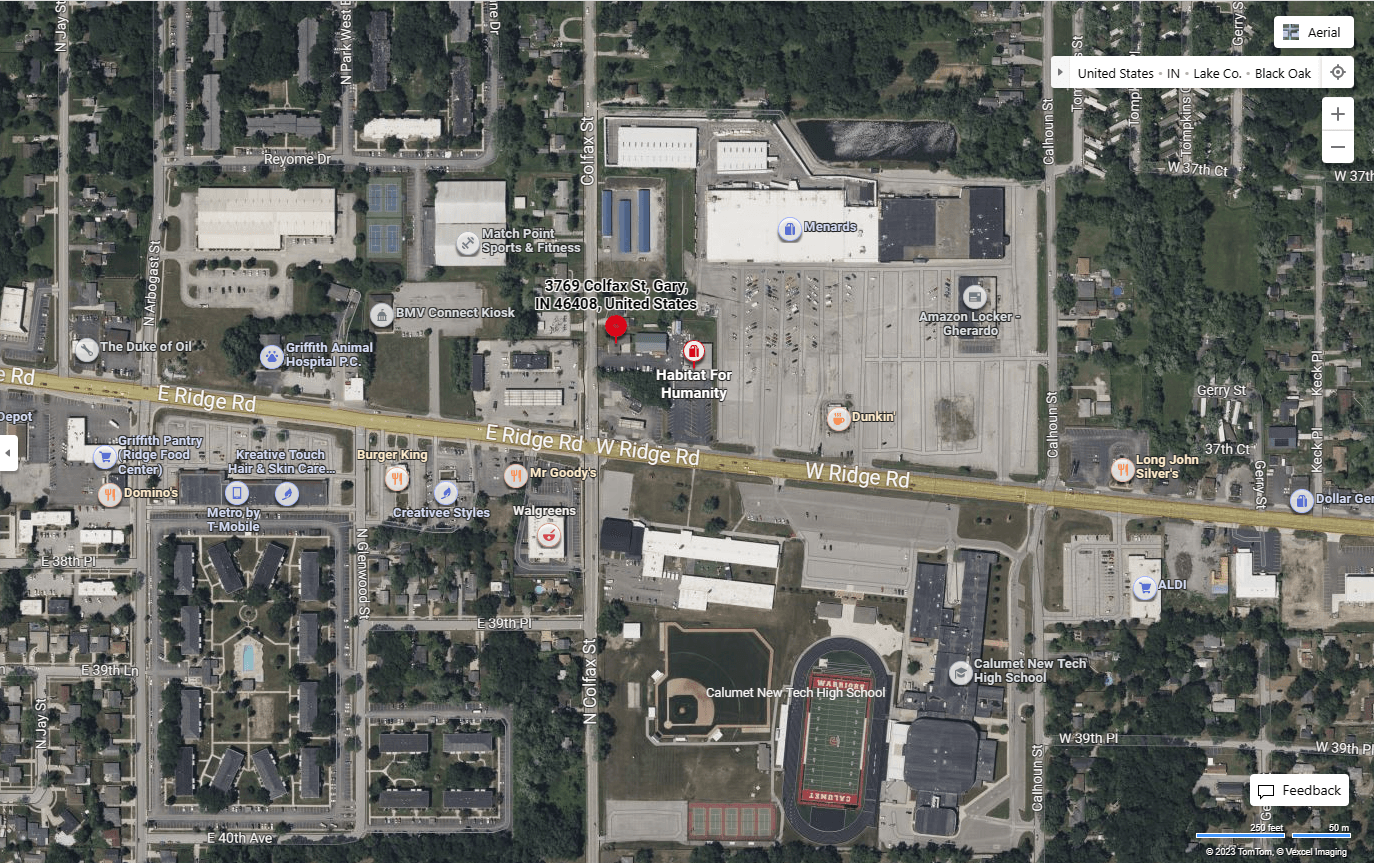

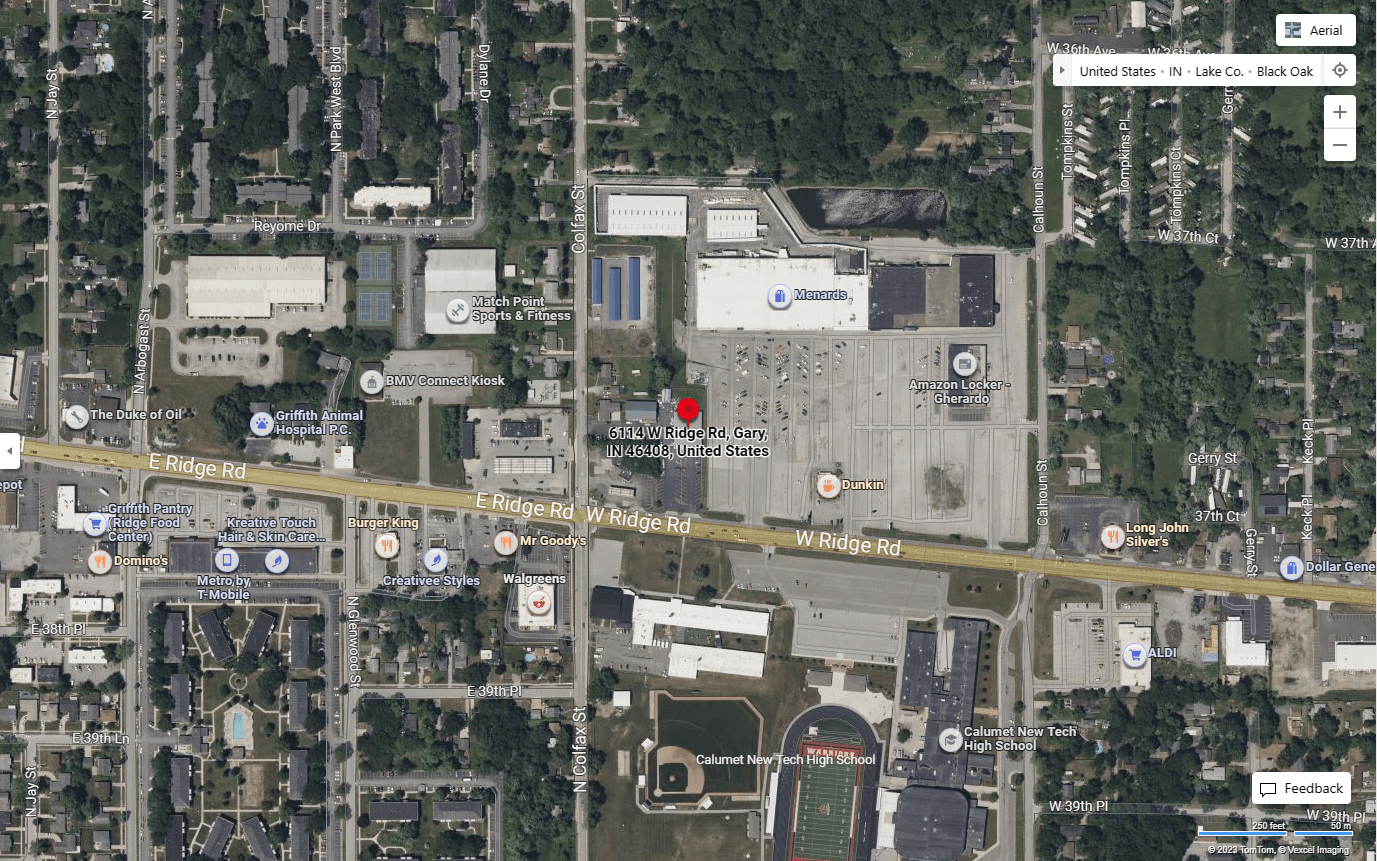

Our Stock Donation Tool

We have invested in an easy-to-use, secure online platform that makes donating stock simple for our supporters. Click Here to Make a Gift of Stock

Using this tool can help you:

- Make a deep and lasting impact on affordable housing in our community without dipping into your everyday cash flow

- Initiate a stock transfer in about 10 minutes

- Notify Habitat for Humanity of Northwest Indiana of your gift automatically. It also lets us know how you want your gift to be used so we can put your gift to work as you intend

- Keep track of your gifts to Habitat for Humanity of Northwest Indiana

Using this tool can help our organization:

- Match the correct donors to their stock gifts (this is incredibly helpful because stock gifts made by donors independently often do not have donor information attached)

- Give you the appropriate tax receipt documents for next year's tax filing purposes

- Thank you properly for your generous contribution!

- It makes each step of the process simple:

- Provide details about the asset you wish to gift and which brokerage it's coming from

- Personalize the gift with a message

Depending on your brokerage, you can either download, print, and mail the forms or submit them to your brokerage electronically. Brokerages that currently accept e-signatures:

- Ameriprise

- Charles Schwab

- Interactive Broker

- ETrade

- Vanguard

- Wells Fargo

We'll reach out with confirmation and thanks when we receive the gift!

FreeWill takes privacy seriously. This platform is trusted and secure and doesn't ask for confidential information such as account numbers or social security numbers. If this information is required to initiate or finalize a transfer, you will input it onto the form independent of the FreeWill platform.

Using this tool also means you don't need to worry about notifying Habitat for Humanity of Northwest Indiana or tracking down our identifying and/or brokerage information — all you do is fill out the forms, and our nonprofit EIN 56-1525939 and brokerage information will populate automatically. When we receive your gift, we will liquidate the stock, and you will receive a confirmation of your gift.

Please share this tool with your financial advisor as you consider donating. If you choose to make a gift, you can share this tool with them, and they can assist you in making it. It can save you both time and help ensure you receive the tax receipts you need.

Frequently Asked Questions

Stock market + portfolio

What if the market fluctuates? Can I still donate stocks?

We recommend seeking professional advice to ensure you can give the most tax-savvy gift based on your assets and circumstances. Stock giving can be a smart choice, even when a market is down or declining. If you hold appreciated assets, you can donate them without changing your portfolio — and you are also exempt from the “wash sale” rule (which prevents someone from selling the stock at a loss and then buying identical stock within 30 days).

I'm convinced that donating stock is a great way to give, but I don't want to lose my holdings.

After donating stock, you are permitted to buy the same stock again within the day (a simple way to redirect the cash you saved by donating stock!). This allows you to make a powerful, tax-savvy gift while maintaining your preferred portfolio.

Can donating stock help me balance/rebalance my stock portfolio?

Yes! If you have appreciated stock and feel confident you're ready to part with it, donating it directly to a nonprofit is a simple and compassionate way to balance (or clean up) your portfolio without any additional cost.

Voilà – you've rebalanced your portfolio charitably!

Habitat for Humanity of Northwest Indiana + stock donations

Does Habitat for Humanity of Northwest Indiana want stock, or do they prefer a cash gift?

Our priority is that each of our donors chooses the gift type that's right for them. However, stock donations can be uniquely impactful for Habitat for Humanity of Northwest Indiana since neither the donor nor our nonprofit has to pay capital gains tax. Practically speaking, that means our donors can give more, and we can put the full value of the stock to work toward our mission.

What will Habitat for Humanity of Northwest Indiana do with the stock?

We will likely immediately liquidate stock donations upon receiving them to minimize any stock market risk associated with holding onto the stock and immediately put the funds to work in fulfilling our charitable mission.

Can all nonprofits receive stock gifts?

As long as a nonprofit has a brokerage account, they can receive in-kind gifts of stock!

Important Disclaimer:

FreeWill offers online self-help solutions for common estate planning needs and related educational content. Estate planning may implicate state and federal laws, and estate planning needs will differ based on personal circumstances and applicable law. FreeWill is not a law firm; its services are not substitutes for an attorney's advice. The information here is provided for educational purposes only and is not intended to provide and should not be construed as providing legal or tax advice. This information is general in nature and is not intended to serve as the primary or sole basis for investment or tax-planning decisions.