We are thrilled to announce that Habitat for Humanity of Northwest Indiana is now offering tax credits! Thanks to the State of Indiana’s Affordable Homeownership Tax Credit, facilitated through Habitat for Humanity of Indiana, your donations are eligible for a tax credit equal to half their value.

This is a fantastic opportunity to make a significant impact on our local community while benefiting from substantial tax savings. See the buttons to the left to download the Donor Form and Eligibility FAQ sheets. The process is straightforward and can make a big difference to you at the taxpayer and to struggling working families here in Lake County, Indiana.

IMPORTANT: We have a limited amount of tax credits available yet for 2025! They are available on a first come first serve basis so act fast!

Contact Jim Drader, Executive Director at 219-923-7265 ext. 1306 or at ed@nwihabitat.org with your questions.

Who:

Tax credits are available for qualified individual taxpayers, small businesses, or corporations in Indiana that donate to Habitat for Humanity of Indiana.

What:

Starting in 2024, these tax credits can be used to offset individual income or business taxes in the year the donation is made. Eligible donations can be checks and credit cards, land, stocks and bonds, or cryptocurrency.

How:

The tax credit is equal to 50% of the donation made to Habitat. For example, a $1,000 gift qualifies you for a $500 tax credit on your Indiana State income tax return. A cap of $10,000 in tax credits (for a $20,000 donation) is allowed per tax year, but any unused credits can be carried over for up to five years. The minimum donation is $1,000 for $500 in tax credits, and the maximum is $20,000 for $10,000 in tax credits.

Where:

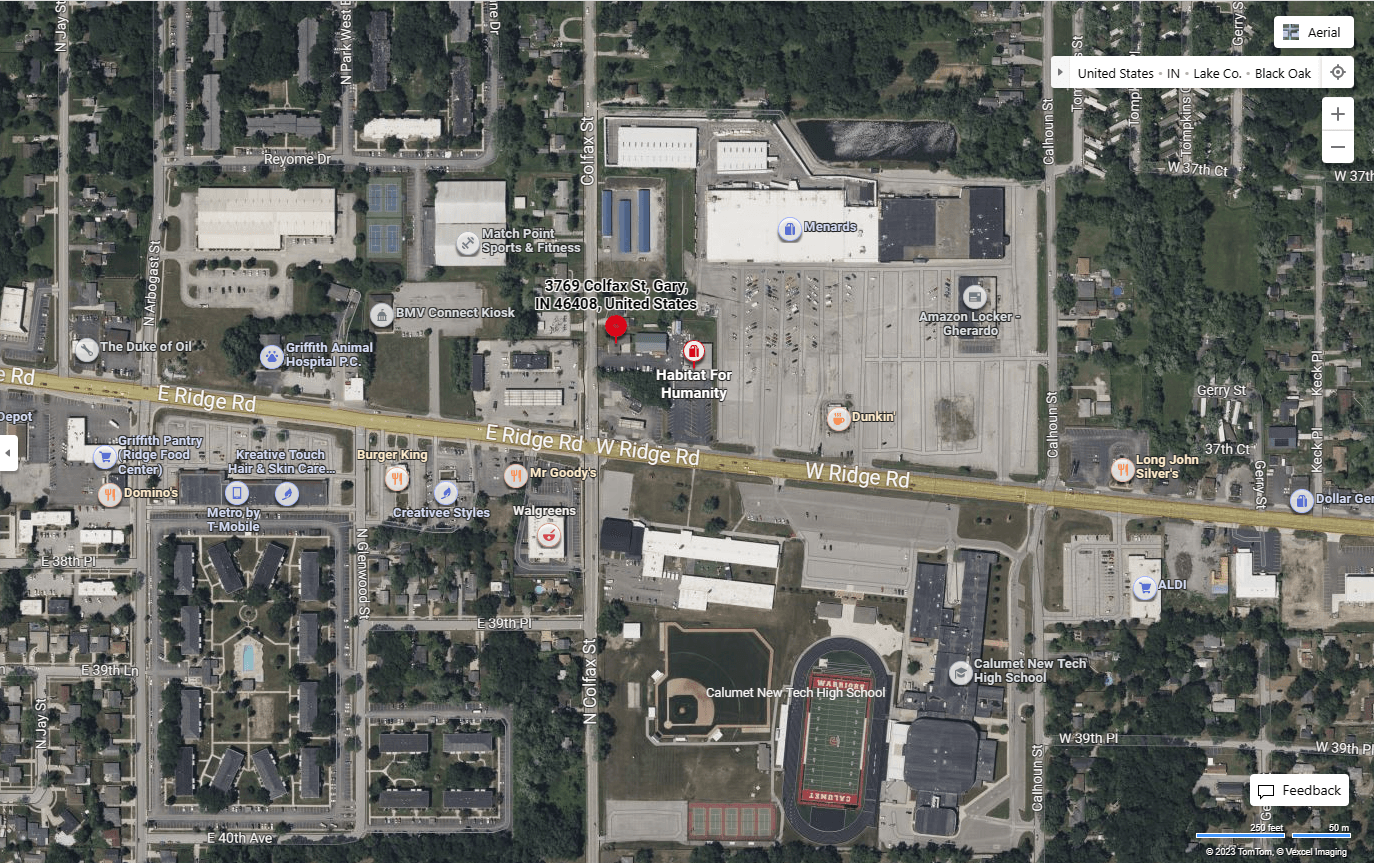

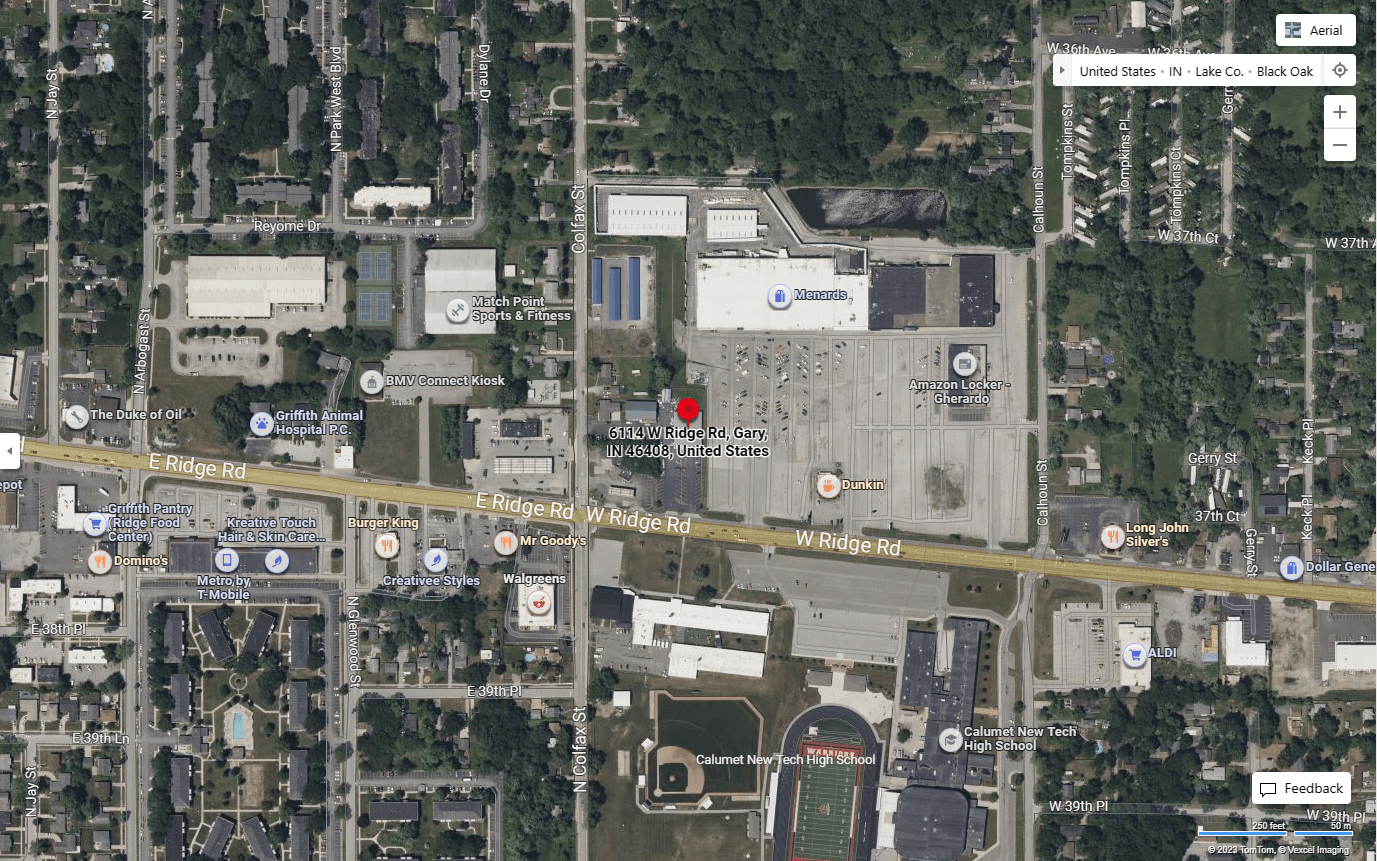

To process the tax credits, donations must be made to Habitat for Humanity of Indiana. Please include the name of the Habitat Affiliate Designation, Habitat for Humanity of Northwest Indiana, on your tax credit form to ensure your donations benefit your local affiliate. Our development director is available to answer any questions and assist you with completing your form.

Contact Jim Drader at 219-923-7265 ext. 1306 or email us at ed@nwihabitat.org regarding any quesitons.

Donate:

To participate, checks must be sent with the completed tax credit form.

Tax Credits are available on a first come first serve basis, so act quickly! Don’t miss this chance to support affordable housing in Lake County while enjoying significant tax benefits. Your generosity helps build stronger communities and brighter futures for local families.